Innovative green taxation and renewable energy transition pathways in developing economies

7/15 2025

Author: Ehsan Rasoulinezhad

Climate change represents a pressing global challenge, yet developing countries encounter disproportionate barriers in transitioning from fossil fuel dependency to renewable energy systems. Structural constraints—including financial limitations, technological deficits, and inconsistent policy frameworks—hinder the rapid adoption of sustainable energy solutions in these regions [1].

Developing countries face formidable structural and institutional barriers in their transition to renewable energy and implementation of green tax policies, including prohibitive upfront costs for clean technology adoption, entrenched fossil fuel subsidies that distort energy markets and discourage investment, institutional weaknesses and governance challenges that undermine policy effectiveness, and the complex dual mandate of expanding energy access while mitigating climate change impacts. These challenges are exacerbated by limited access to financing, technological gaps, competing development priorities, and the political economy risks associated with energy subsidy reforms, which often trigger social unrest when implemented without adequate compensatory measures, collectively creating a vicious cycle that perpetuates both energy poverty and climate vulnerability while delaying the transition to sustainable energy systems [2].

Well-designed green fiscal instruments—including carbon pricing mechanisms and pollution taxes—can effectively accelerate the transition to renewable energy systems while maintaining economic efficiency and distributional equity, as demonstrated by successful policy implementations in European and East Asian contexts:

•Carbon Tax with Revenue Recycling – Tax on CO2 emissions, but money come back to people or business as subsidy for solar panels, energy efficiency, or cash support for poor families. Example: British Columbia (Canada) reduced emissions without hurting economy.

•Tax-Break for Green Investment – Reduce tax for companies that invest in wind, solar, or energy storage. Japan’s Green Innovation Fund (established in March 2021) supports such projects.

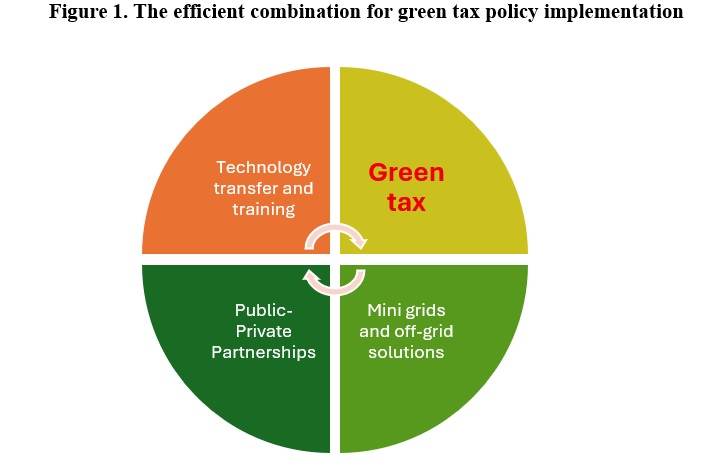

•Border Carbon Tax (CBAM) – Tax on imports based on CO2 footprint. This can push other countries to go green. EU is doing this; Japan can also lead in Asia. However, tax policy constitutes only one component of an effective decarbonization strategy; it must be strategically integrated with the following complementary measures as illustrated in Figure 1.

•Public-Private Partnerships (PPP) – Government and business work together to lower risk for investors. Example: Morocco’s Noor Solar Plant (biggest in world) used PPP model.

•Mini-Grids and Off-Grid Solutions – In rural areas, small solar systems can give electricity fast without waiting for big power plants. Bangladesh has installed over 6 million solar home systems.

•Technology Transfer & Training – Japan can help by sharing know-how (like smart grids, battery storage) and training local workers.

Japan possesses a unique opportunity to operationalize its technological and policy leadership in climate mitigation by establishing structured cooperation frameworks with developing nations. Building on its domestic successes in renewable energy deployment and carbon management, Japan should implement a three-pronged support strategy: (1) financing demonstration projects for carbon pricing mechanisms and grid-scale renewable integration, (2) providing technical assistance for sequenced fossil fuel subsidy reforms incorporating social safety nets, and (3) catalyzing blended finance mechanisms to de-risk private sector clean energy investments [3]. This approach should be complemented by institutionalized technology transfer programs focusing on next-generation solutions—particularly high-efficiency solar PV, modular battery storage systems, and hydrogen infrastructure—while leveraging multilateral forums (G20, ASEAN+3) to advance harmonized carbon market standards.

In conclusion, effective climate policy must balance equity, transparency, and impact to avoid regressive outcomes while driving decarbonization. Developing nations can leapfrog carbon-intensive development with international support—particularly from technologically advanced economies like Japan. By sharing expertise in carbon pricing design and renewable integration, while avoiding developed countries' past coal dependencies, we can simultaneously advance climate action and energy access in line with global sustainability goals.

References

[1] Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency, 15, 2, doi: https://doi.org/10.1007/s12053-022-10021-4

[2] Rasoulinezhad, E. (2025). Green taxes innovation and energy imports in advancing renewable transitions in developing countries. Resources Policy, 102, 105517, doi: https://doi.org/10.1016/j.resourpol.2025.105517

[3] Yoshino, N., Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2021). Economic impacts of carbon tax in a general equilibrium framework: empirical study of Japan. Journal of Environmental Assessment Policy and Management, 23, 01, 2250014, doi: https://doi.org/10.1142/S1464333222500144